Delinquent Property Taxes Ohio . The following parcels have been certified delinquent with taxes, assessments, interest, and penalties, charged. Ask how to set up a. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. Options available to local officials for enforcing the state’s lien on delinquent property. First, the delinquent amount becomes a lien on the home. Ohio law provides various avenues to enforce the. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. Then, if you don't pay off the debt, the taxing authority could sell your home,.

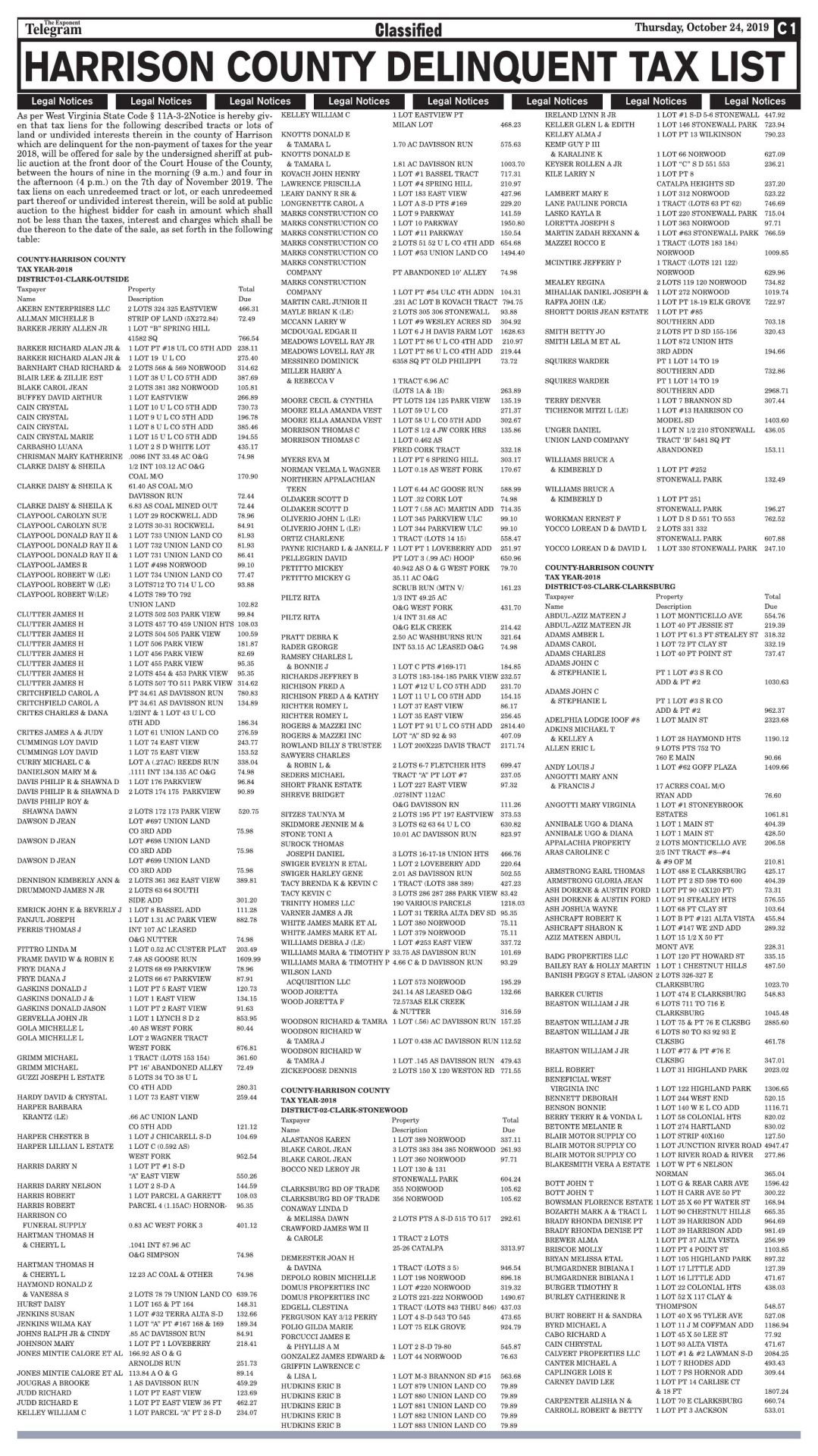

from www.wvnews.com

First, the delinquent amount becomes a lien on the home. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. Ask how to set up a. Options available to local officials for enforcing the state’s lien on delinquent property. Ohio law provides various avenues to enforce the. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. Then, if you don't pay off the debt, the taxing authority could sell your home,. The following parcels have been certified delinquent with taxes, assessments, interest, and penalties, charged. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer.

Harrison County Delinquent Tax List Harrison County legals

Delinquent Property Taxes Ohio Ask how to set up a. Ask how to set up a. Then, if you don't pay off the debt, the taxing authority could sell your home,. Ohio law provides various avenues to enforce the. First, the delinquent amount becomes a lien on the home. The following parcels have been certified delinquent with taxes, assessments, interest, and penalties, charged. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. Options available to local officials for enforcing the state’s lien on delinquent property. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office.

From rethority.com

How to Find Tax Delinquent Properties in Your Area Delinquent Property Taxes Ohio Options available to local officials for enforcing the state’s lien on delinquent property. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. The following parcels have been. Delinquent Property Taxes Ohio.

From www.youtube.com

How to Find Tax Delinquent Properties YouTube Delinquent Property Taxes Ohio Ohio law provides various avenues to enforce the. Ask how to set up a. Then, if you don't pay off the debt, the taxing authority could sell your home,. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. The following is a list of the services and duties of the. Delinquent Property Taxes Ohio.

From boone.countyclerk.us

Delinquent Property Tax Boone County Clerk's Office Delinquent Property Taxes Ohio Options available to local officials for enforcing the state’s lien on delinquent property. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. The following parcels have been certified delinquent. Delinquent Property Taxes Ohio.

From www.facebook.com

Delinquent Property Tax Help Delinquent Property Taxes Ohio First, the delinquent amount becomes a lien on the home. Ohio law provides various avenues to enforce the. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. Then, if. Delinquent Property Taxes Ohio.

From www.wvnews.com

Harrison County Delinquent Tax List Harrison County legals Delinquent Property Taxes Ohio The following parcels have been certified delinquent with taxes, assessments, interest, and penalties, charged. Ask how to set up a. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. Then, if you don't pay off the debt, the taxing authority could sell your home,. First, the delinquent amount. Delinquent Property Taxes Ohio.

From www.taxdefensepartners.com

What Can Delinquent Property Taxes Do To You? Tax Defense Partners Delinquent Property Taxes Ohio First, the delinquent amount becomes a lien on the home. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. Ask how to set up a. Options available to local officials for enforcing the state’s lien on delinquent property. Every effort is made by the stark county treasurer’s office. Delinquent Property Taxes Ohio.

From www.flickr.com

Delinquent Property Tax Loans There are multiple instances… Flickr Delinquent Property Taxes Ohio Options available to local officials for enforcing the state’s lien on delinquent property. Then, if you don't pay off the debt, the taxing authority could sell your home,. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. Ohio law provides various avenues to enforce the. Ask how to set up. Delinquent Property Taxes Ohio.

From www.daytondailynews.com

Proposed Ohio Senate Bill 186 would require payment of delinquent taxes Delinquent Property Taxes Ohio Then, if you don't pay off the debt, the taxing authority could sell your home,. First, the delinquent amount becomes a lien on the home. Options available to local officials for enforcing the state’s lien on delinquent property. The following parcels have been certified delinquent with taxes, assessments, interest, and penalties, charged. You usually get at least one chance to. Delinquent Property Taxes Ohio.

From www.templateroller.com

Athens County, Ohio Affidavit of Bidder Regarding Delinquent Personal Delinquent Property Taxes Ohio The following parcels have been certified delinquent with taxes, assessments, interest, and penalties, charged. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. First, the delinquent amount becomes a lien on the home. Ask how to set up a. Ohio law provides various avenues to enforce the. Every. Delinquent Property Taxes Ohio.

From www.pdffiller.com

Fillable Online Frequently Asked Question for Delinquent Property Tax Delinquent Property Taxes Ohio First, the delinquent amount becomes a lien on the home. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. Options available to local officials for enforcing the state’s lien. Delinquent Property Taxes Ohio.

From www.formsbank.com

Fillable Form Et 21 Application For Certificate Of Release Of Ohio Delinquent Property Taxes Ohio Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. Ask how to set up a. You usually get at least one chance to enter into an agreement called a. Delinquent Property Taxes Ohio.

From www.uslegalforms.com

Sample Letter for Delinquent Taxes Delinquent Property Taxes US Delinquent Property Taxes Ohio Ohio law provides various avenues to enforce the. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. You usually get at least one chance to enter into an agreement. Delinquent Property Taxes Ohio.

From www.youtube.com

How To Get Tax Delinquent Lists! Wholesaling Real Estate YouTube Delinquent Property Taxes Ohio Ask how to set up a. Options available to local officials for enforcing the state’s lien on delinquent property. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. Then, if you don't pay off the debt, the taxing authority could sell your home,. First, the delinquent amount becomes a lien. Delinquent Property Taxes Ohio.

From communityprogress.org

Delinquent Property Tax Enforcement Center for Community Progress Delinquent Property Taxes Ohio You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. Ohio law provides various avenues to enforce the. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. Options available to local officials for enforcing the state’s lien on delinquent. Delinquent Property Taxes Ohio.

From www.youtube.com

Delinquent Property Tax Redemption Process YouTube Delinquent Property Taxes Ohio Then, if you don't pay off the debt, the taxing authority could sell your home,. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. First, the delinquent amount becomes a lien on the home. The following is a list of the services and duties of the delinquent tax. Delinquent Property Taxes Ohio.

From www.usdirecthomebuyers.com

How To Handle Delinquent Property Taxes Delinquent Property Taxes Ohio Ohio law provides various avenues to enforce the. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. The following parcels have been certified delinquent with taxes, assessments, interest, and penalties, charged. First, the delinquent amount becomes a lien on the home. Options available to local officials for enforcing. Delinquent Property Taxes Ohio.

From tarentumboro.com

Delinquent Property Tax List Published • Tarentum Borough Delinquent Property Taxes Ohio The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. You usually get at least one chance to enter into an agreement called a delinquent tax contract with your county treasurer. First, the delinquent amount becomes a lien on the home. Every effort is made by the stark county. Delinquent Property Taxes Ohio.

From renewedhomesmi.com

What Does It Mean To Be Delinquent on Property Taxes? Renewed Homes Delinquent Property Taxes Ohio Ohio law provides various avenues to enforce the. Then, if you don't pay off the debt, the taxing authority could sell your home,. Ask how to set up a. Every effort is made by the stark county treasurer’s office to avoid foreclosure proceedings to collect an outstanding balance. You usually get at least one chance to enter into an agreement. Delinquent Property Taxes Ohio.